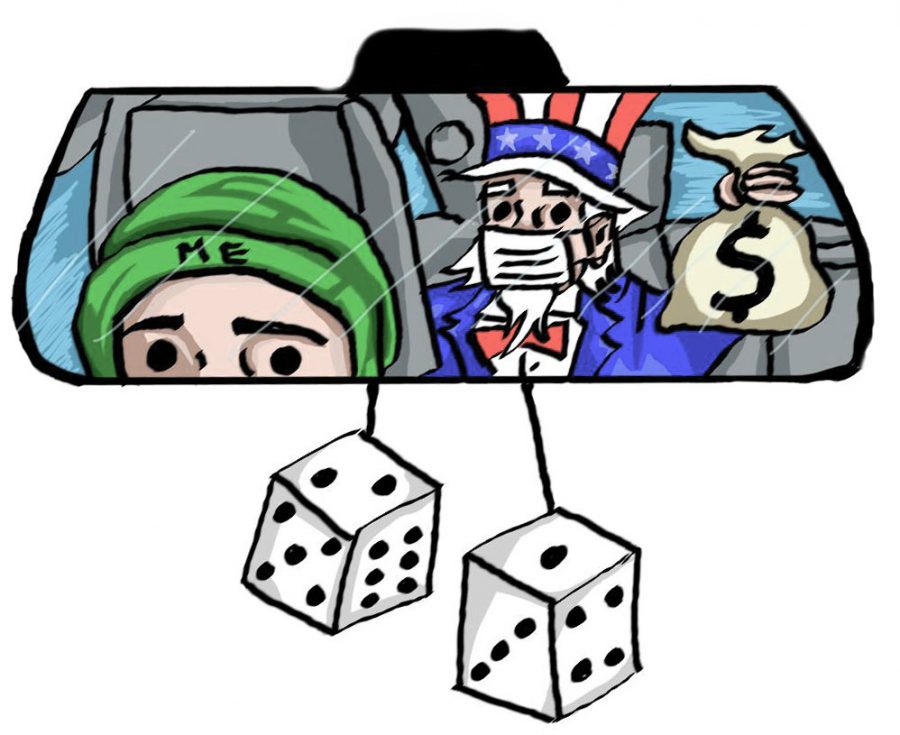

The auto finance boom during a pandemic

March 30, 2021

The auto finance business provides a necessary service – transportation. According to CNBC, the emergence of COVID-19 increased the demands for personal transportation. The purchase of used cars compared to before the pandemic skyrocketed.

According to WardsAuto, stimulus checks and unemployment benefits are commonly used for the purchase of a used car. This affected students and auto finance companies positively.

In an email to The Courier, Inske Zandvliet, economics professor at Dallas College Brookhaven Campus, said the demand for used cars is higher due to COVID-19. “People want to avoid traveling on public transport, so they are purchasing cars,” she said. “This leads to the second reason – a new car is a larger purchase. Since economic times are now uncertain, in terms of employment, many people choose to purchase a used car since it is not as expensive.”

The stimulus checks and unemployment benefits helped not only essential workers, but students as well. Alora White, a Dallas College student, was let go from her job due to the pandemic. “I had to apply for unemployment and by doing so I purchased a used car,” she said.

White said prior to the pandemic she had to rely on public transportation. “I am much happier having a car,” White said. “I don’t have to worry about the possibility of getting infected and I can get to where I need to without worries.”

Due to the sudden demand for used cars, auto finance companies such as Vehicle Solutions Corp profited, according to CNBC Evolve.

VSC is an indirect auto-finance company based in Miami with a satellite location in Arlington. Jorge Hernandez, VSC’s risk analyst, said dealers submit contracts and VSC reviews them to decide whether to fund and service a loan.

When the pandemic began affecting the U.S. in March 2020, VSC tightened its underwriting guidelines, meaning it funded fewer, but higher quality loans than it previously had. The change caused the number of loans booked to decrease.

“Initially, when we cut back on funding, our projections showed an equal drop in revenue for the company,” Hernandez said. “However, what we initially thought could be catastrophic for a company of our size actually ended up being a stabilizing force.”

The company remained stable and exceeded expectations performance-wise based on projections made by Hernandez.

David Ricci, the company’s repossession manager, said his workload remained steady. “I was expecting to have to repo a lot more cars in the beginning,” Ricci said. “But as it went on, the collections teams ended up keeping the customers current or making payment arrangements, so they didn’t get repossessed.” Meaning payments for used cars were being paid in full and on time.

Because used cars were selling better, there was a demand for them. “The subprime market was pretty strong, so the cars we did repo sold for a good amount,” Ricci said. The proceeds of the sales helped to offset the losses from cutting back on funding. Customers were able to successfully pay for and purchase their vehicles, especially used cars, thanks to the stimulus checks and unemployment benefits.